Have you prepared an estate plan? If you haven’t, you are not alone. A 2016 Gallup poll states that 56% of Americans do not have a will. I would bet that you think you are too young, you are too busy, and you do not have an “estate” that requires planning. If you have children, however, an estate plan is essential. I think we would all agree that our children are our greatest asset. Yet too few parents take the steps to plan for the worst-case scenario. Consider the following reasons to have an estate plan if you have minor children.

Naming Guardians of Your Minor Children

This is obviously the number one reason that every parent should have an estate plan in place. You need to designate a guardian (and quite possibly a back up guardian) for any minor children you might leave behind. If you don’t name or nominate a guardian for your minor children, the State of New Mexico may decide who gets to raise your children–even if it is the last person that you would want to raise your children. In addition, there may be an unending court battle between family members over who should raise your children. Naming a guardian for your minor children will help ease the transition of an incredibly hard time. When you name a guardian for your children, you will need to find someone who shares your values and will raise your children the way you would want them raised.

Protecting the Assets for Your Children

If you die without an estate plan in place, your children will receive any assets of your estate–outright at the age of 18. Before they reach 18, they will also need funds to support them as they grow. There are estate planning tools that can ensure that the funds are properly managed and held in trust for your children’s needs as you designate. In addition, the funds can be held for your children beyond their eighteenth birthday, say until they reach the age of 25 or finished college. You may even have reasons to place the funds in a lifetime trust, which will protect your children’s inheritance from creditors and/or spouses.

Planning When You Have a Blended Family

Blended families can certainly be a blessing, but they can also cause issues. How will children of a previous relationship be provided or cared for if the biological parent passes away? If you are the stepparent, you may want to help provide for your stepchildren, or you may want to keep your finances separate. There are many variables and proper estate planning can help you plan for your unique situation.

Preparing a Power of Attorney in the Event That You Are Incapacitated or Disabled

Even if you have a will or have nominated guardians in a will, a will does not work unless you have died. A power of attorney provides a tool for another individual that you trust to manage your finances or make medical decisions for you in the event that you are incompetent. You can also prepare a medical power of attorney for your children that allows caregivers to make medical decisions if you are unavailable.

Life is complicated and busy. No one wants to think about death. You have to consider the possibility that you may not be there for your children. If you are not there for your children, you need to have a plan in place that would protect them as though you were there. The estate planning is not for you; it is for the ones that you love.

If you are interested in learning more about estate plans, Grieta Gilchrist Law Firm, LLC will be hosting a Wine & Wills Seminar on June 17 at 6 pm. This seminar will cover the basics of estate planning and give you an opportunity to meet Grieta and ask questions. Register for the free seminar.

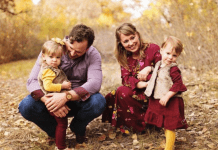

About Our Guest Blogger

Grieta is married to her husband of 19 years. Together they are the parents to three children, ranging from 15 years old to 9 years old. After receiving her undergraduate degree from University of New Mexico, Grieta and her husband moved to Boston, Massachusetts, where she worked as research engineer. After a few years of missing her home and a strong desire to work with people, not things, Grieta and her husband moved back to Albuquerque. Grieta began law school at the University of New Mexico School of Law.

Grieta is married to her husband of 19 years. Together they are the parents to three children, ranging from 15 years old to 9 years old. After receiving her undergraduate degree from University of New Mexico, Grieta and her husband moved to Boston, Massachusetts, where she worked as research engineer. After a few years of missing her home and a strong desire to work with people, not things, Grieta and her husband moved back to Albuquerque. Grieta began law school at the University of New Mexico School of Law.

Grieta had her first child during law school and her second one within two years of graduating law school. She was busy and kept putting off estate planning, though she knew it was important. Finally, when she and her husband were traveling out of the country, they decided to put an estate plan in place. The plan was quickly outdated and would not have worked the way Grieta wanted it to if something had happened to her and her husband. That is why Grieta has moved from a litigation practice to an estate planning practice with the focus on helping young families plan for the unthinkable. Contact Grieta by visiting her website.